Apartment Loan rates start as low as 5.88% (as of April 24th, 2024)

• A commercial mortgage broker with over 30 years of lending experience

• No upfront application or processing fees

• Simplified application process

• Financing up to 80% LTV

• Terms and amortizations up to 30 years

• Long term fixed rates

• Loans for purchase and refinance, including cash-out

• 24 hour written pre-approvals with no cost and no obligation

Recent TRUSTPILOT Reviews

Select Commercial Funding Reviews from TRUSTPILOT

A three year journey

"Thanks Stephen for all of your hard work in getting our deal closed! I appreciate your professionalism and patience throughout a complicated process. You always were there for my partner and I whenever we had questions and needed answers quick. It was a pleasure to have worked with you and Select Commercial!"

Apartment Loan

Apartment Loan

We are experts in securing apartment building loans. Sometimes referred to as multifamily loans, these types of loans have traditionally constituted the largest portion of our total business volume. We have information that can help you with How to Buy an Apartment Building. Whether you are looking to finance a small apartment building, a complex with hundreds of units, or a co-operative looking for an underlying mortgage, we can help you find the optimal financing solution to meet your apartment mortgage loan needs. Our company has access to multiple capital sources, including: Fannie Mae, Freddie Mac, HUD, numerous local and national banks, Wall Street conduit lenders, Agency lenders, credit unions and insurance companies. We will entertain multifamily loan requests of all sizes, beginning at $1,500,000. See our article published in a major magazine on How to Invest in an Apartment Building. We arrange financing for the following:

- Large urban high-rise apartment buildings

- Suburban garden apartment complexes

- Small apartment buildings containing 5+ units

- Underlying cooperative apartment building loans

- Portfolios of small apartment properties and/or single-family rental properties

- Other multi-family and mixed-use properties

Our company has multiple capital sources for these loans, including: Fannie Mae, Freddie Mac, FHA, national banks, regional and local banks, insurance companies, Wall Street conduit lenders, credit unions and private lenders. Whether you are purchasing or refinancing, we have the right solutions available. We will entertain loan requests of all sizes, beginning at $1,500,000. Get started with a Free Loan Quote.

Indiana Apartment Loan Refinance

Apartment loan refinance of a 224 unit complex known as Compass Pointe I and II, located in Valparaiso IN .

Indiana Apartment Loan Refinance

Apartment loan refinance of a 224 unit complex known as Compass Pointe I and II, located in Valparaiso IN .

-

$17,281,000 loan

-

10 year fixed rate

-

30 year amortization

-

Non-recourse debt

Get Free Quote

Connecticut Apartment Loan Refinance

Apartment loan refinance of a 90 unit garden two story complex known as Crossroads of Enfield, located in Enfield Connecticut.

Connecticut Apartment Loan Refinance

Apartment loan refinance of a 90 unit garden two story complex known as Crossroads of Enfield, located in Enfield Connecticut.

-

$6,000,000 loan

-

10 year fixed rate

-

30 year amortization

-

Non-recourse debt

Get Free Quote

Texas Aaprtment Loan Refinance

Apartment loan refinance of a 54 unit garden low-rise apartment complex in Port Arthur (Nederland) Texas.

Texas Aaprtment Loan Refinance

Apartment loan refinance of a 54 unit garden low-rise apartment complex in Port Arthur (Nederland) Texas.

-

$5,932,000 loan

-

10 year fixed rate

-

30 year amortization

-

Lower rate and cash out

Get Free Quote

Texas Apartment Loan Refinance

Commercial mortgage refinance of a 26 unit “C” class market rate apartment complex located in Nederland Texas.

Texas Apartment Loan Refinance

Commercial mortgage refinance of a 26 unit “C” class market rate apartment complex located in Nederland Texas.

-

$3,559,000 loan

-

10 year fixed rate

-

30 year amortization

-

Non-recourse debt

Get Free Quote

North Carolina Multifamily Loan

Apartment building refinance (with cash-out) of a 59-unit apartment complex located in Mooresville NC.

North Carolina Multifamily Loan

Apartment building refinance (with cash-out) of a 59-unit apartment complex located in Mooresville NC.

-

$2,050,000 loan

-

10 year fixed rate

-

30 year amortization

-

Lower rate and cash out

Get Free Quote

Denver Apartment Loan

Multifamily financing for an apartment complex located in Denver, Colorado. The property consists of 84 units.

Denver Apartment Loan

Multifamily financing for an apartment complex located in Denver, Colorado. The property consists of 84 units.

-

$3,000,000 loan

-

10 year fixed rate

-

30 year amortization

-

Refinance high rate debt

Get Free Quote

Oregon Multifamily Loan

Apartment mortgage loan to purchase a 12-unit apartment building located in Keizer (Salem) OR.

Oregon Multifamily Loan

Apartment mortgage loan to purchase a 12-unit apartment building located in Keizer (Salem) OR.

-

$1,200,000 loan

-

10 year fixed rate

-

30 year amortization

-

Acquisition financing

Get Free Quote

Chicago Multifamily Loan

The Cook county property consists of 21 total units, 20 apartments and one office on the ground floor.

Chicago Multifamily Loan

The Cook county property consists of 21 total units, 20 apartments and one office on the ground floor.

-

$2,065,000 loan

-

10 year fixed

-

30 year amortization

-

Refinance high rate debt

Get Free Quote

Economic Outlook for 2020 Multifamily Loans

Multifamily Rent and Home Payment Gap Widening

Multifamily Rent and Home Payment Gap Widening

For various reasons, the 2020 American economy has taken a big hit recently. With the current outbreak of Covid-19, the overall economy has been in flux. The stock market has been fluctuating wildly and commercial mortgage interest rates have been severely impacted. Huge metros such as New York have all but shut down much economic activity and entertainment. In this unsteady climate, many investors are scared to purchase commercial real estate and to take out commercial mortgages and multifamily loans. Multifamily loan rates initially dropped to record lows at the beginning of the year, but since the pandemic, as lenders became more wary of a recession, apartment loan rates began to steadily rise. Currently, many lenders have put measures in place to significantly reduce the risk of multifamily loan lending. For example, many apartment loans undertaken in April have required significant debt service reserves and have been sized to lower LTV rates than in the past. Additionally, the oil industry has taken a big hit. Not only are people traveling less due to the pandemic, foreign countries like China and Russia are involved in a huge price war which is driving the price of oil way down. The international trade war has also continued to complicate our national economic outlook. Experts predict that this trade war will continue to be a massive wildcard for the American economy. While a phase one trade deal was reached and multiple tariffs were suspended in the second half of last year, negotiations are expected to continue further into 2020 and to taper growth. Declining global economies and the potential impact of Brexit are expected to further restrain our economic growth. The upcoming U.S. election in November 2020 is another factor that may cause market uncertainty, possibly deterring investor decision making.

2020 Multifamily Loan Overview

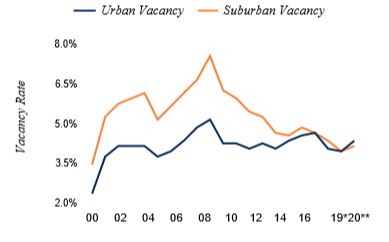

Suburban Multifamily vs Urban

Suburban Multifamily vs Urban

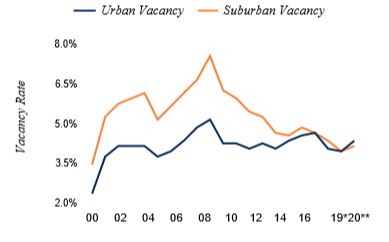

It is very important for multifamily investors to understand the landscape of the national apartment industry. Experts have anticipated a slight rise in the national apartment vacancy rate in 2020. While some may think that this rise reflects diminishing demand, experts are convinced that it actually stems from a shortage of class B and class C apartments. Interested renters are expected to face difficulty finding an available apartment as workforce housing vacancy has dropped incredibly. While construction of new multifamily units will help a little, the largely Class A additions will not completely align with the needs of renters looking for more affordable apartment units. Given the high demand, many investors are still looking for multifamily loans to purchase new multifamily properties. Although many markets have witnessed a revitalization of their urban centers, the larger national housing trends significantly favor suburban areas and investors are increasingly looking for multifamily loans / apartment loans to purchase properties in these locations. Millennials are now taking on significant lifestyle changes such as marriage and starting families. These people are looking to move into more suburban areas. When one compares the vacancy rate in urban and suburban areas over the past five years, the preference for the latter is clear. Over this time period the nationwide urban vacancy rate has decreased 20 basis points while the suburban vacancy rate has dropped 100 basis points. With regards to rent, experts anticipate that rent gains will differ significantly based on city and apartment class. Class C apartments are expected to rise the most with an anticipated 4.3 percent gain as vacancy for this class remains incredibly low. Growth in Class A and B apartment units are expected be more modest, with rates in the mid 3% range. While the expected national average rent growth for multifamily units sits at 3.8 percent national, several metros such as Las Vegas, Phoenix and Nashville are expected to surpass that number as they have benefitted tremendously from significant population additions employment growth. Although there are a lot of uncertainties in the market right now, multifamily investors are still actively in pursuit of multifamily loans to help make their next purchase.

Apartment Loans in 2020

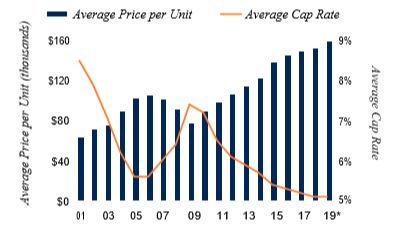

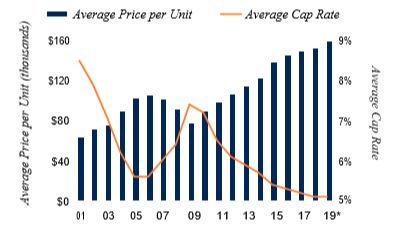

Multifamily Price and Cap Rate Trends

Multifamily Price and Cap Rate Trends

With regards to mortgage origination and apartment loans, low interest rates and strong multifamily performance are expected to help loan volumes grow. Experts predict that the origination volume in 2020 will increase by 5.7% to $390 billion. Market data indicates that cap rates have more room to decline, which will lead to increasing property values and should drive up origination volume. Rent growth is expected to moderate and vacancy rates will probably increase modestly over the rest of the year. As cap rates decline and market fundamentals improve property values are expected to rise and lead to higher origination volumes and more multifamily loans. Lifestyle preferences, demographics and the lack of available houses to purchase at lower price points will keep many potential home buyers in multifamily units. Given all of these metrics, investors are still very interested in taking out apartment loans to purchase properties in 2020.

What Happened with Apartment Loans in 2019

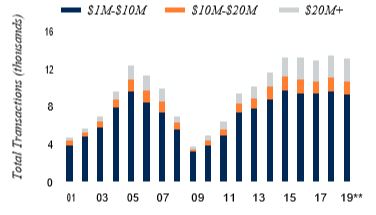

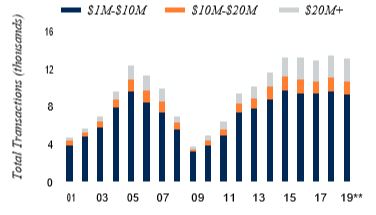

Apartment Investment Transactions Moderating

Apartment Investment Transactions Moderating

The multifamily market ended the 2019 year on a high note. Despite increased levels of new units entering the market, the apartment sector maintained strong and steady growth throughout the year. Vacancy rates throughout the country remained fairly stable, easing investors’ concerns of a significant decline in occupancy due to the high sum of multifamily units delivered. Furthermore, rent growth on the national and metropolitan levels remained healthy throughout the year. While 2019 rent growth was more modest than 2018, it was in line with 2016 and 2017 levels and remained above the national historic average of 3.4%. Based on data provided by the U.S. Census Bureau, multifamily completions increased slightly in 2019 when compared with 2018. The data also show that reported permit growth has increased 3% and starts are up 2%. Based on 2019 data, these metrics suggest that the supply will remain elevated over the next few years. In terms of multifamily mortgage origination, the most up to date information has surpassed expectations. Mortgage Bankers Association reported that the 2018 mortgage volume came in at about $339 billion, an increase of 18.9% from 2017. While the actual 2019 numbers will not be available until later this year, experts estimate that due to solid fundamentals, low interest rates and heightened demand for multifamily investments, the total apartment loan origination volume last year was about $369 billion.

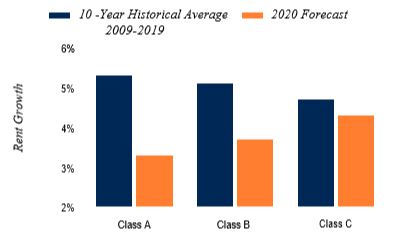

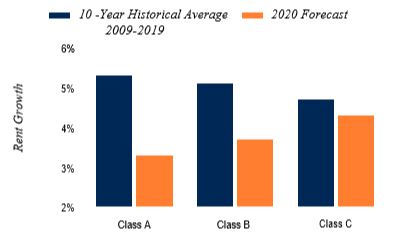

Apartment Rental Growth by Class

Apartment Rental Growth by Class

The 2019 economy thrived overall. Throughout the year 2.1 million jobs were added which were in line with 2017 number (although it fell short of the 2018 total of 2.7 million). The unemployment rate also continued to decrease in 2019 as it went down 50 basis points to 3.5% at the end of the year. This number matched the lowest unemployment rate in fifty years. The labor market heavily supported increased salaries, as indicated by the 2.8% annual growth in the Employment Cost Index as of September of 2019. While these gains were below the expected amount for a market with such a low unemployment rate they were above the average for the past decade. At the beginning of the year many investors were concerned due to expectations of a recession. There were many indicators that supported this concern such as inverted two and ten year yield curves, an unanticipated rise in the June unemployment rate of ten basis points, an unstable stock market and slowed job growth. However, during the third and fourth quarters of 2019, the economy improved as job growth rose, the unemployment rate fell. This economic improvement has had a clear impact on the multifamily market as more investors are feeling bullish on putting their money into this asset class.

Fannie Mae Multifamily Financing

Fannie Mae is one of the nation’s leading secondary market sources of capital for apartment building financing. Fannie Mae provides mortgage capital for conventional, affordable housing, cooperatives, senior housing, student housing, manufactured housing communities and mobile home parks nationwide. Fannie Mae's apartment loan program offers many distinct advantages over traditional bank programs, including: long-term fixed rates up to 30 years, high LTV ratios up to 80%, and nonrecourse financing (no personal guarantee to the principals).

Fannie Mae Apartment Loans - Small Balance

| Fannie Mae Apartment Loan - Small Balance |

| Minimum Loan Amount |

Max LTV |

Term |

Amortization |

| $1,000,000 |

Tiered pricing from 55% – 80% |

5 to 30 years |

Up to 30 years |

Fannie Mae Apartment Loans - Large Balance

| Fannie Mae Apartment Loan - Large Balance |

| Minimum Loan Amount |

Max LTV |

Term |

Amortization |

| $6,000,000 |

Tiered pricing from 55% – 80% |

5 to 30 years |

Up to 30 years |

Freddie Mac Apartment Loan Program - Small Balance

Freddie Mac is another nationwide source of mortgage capital for apartment building financing. The Freddie Mac small balance apartment loan program offers many unique and beneficial features for apartment purchases and refinances, with a minimum loan size of $1,500,000. The loan application process is simple and streamlined. As an example, tax returns for the borrower and the property are not required. Loans typically close in 45 days and the program has much lower costs than other government or agency programs. Loans are non-recourse, which means that the borrower is not required to guarantee payments personally. Prepayment penalties are flexible, ranging from yield maintenance to soft stepdown. Perhaps the best feature is that Freddie Mac offers a free rate hold for 45 days from application. If rates change during the processing period, the loan rate is automatically held from the date of application.

| Freddie Mac Apartment Loan - Small Balance |

| Minimum Loan Amount |

Max LTV |

Term |

Amortization |

| $1,000,000 |

Tiered pricing from 55% – 80% |

5, 7, and 10 Year Fixed Rates |

Up to 30 years |

Bank Apartment Loan Program

In addition to offering loans from agency lenders Fannie Mae and Freddie Mac, we also offer many different bank and portfolio loan programs. While the agency lenders typically have the lowest rates available in the market, many times the borrower would be better off obtaining an apartment building loan from a traditional portfolio lender. Often times, a portfolio product will better serve the needs of the borrower by offering more flexible underwriting and loan terms.

| Minimum Loan Amount |

Max LTV |

Term |

Amortization |

| $1,000,000 |

Tiered pricing from 55% – 75% |

5, 7, and 10 Year Fixed Rates |

Up to 30 years |

Commercial Mortgage-Backed Securities (CMBS Loans)

Another major source of mortgage capital for apartment building loans is the commercial mortgage-backed securities market through Wall Street investment banks. CMBS lenders make individual loans to borrowers which are then packaged and sold to investors as securities. These loans provide interest rate yield to their investors while contributing liquidity to the capital markets. This liquidity in the markets means lower commercial mortgage rates to borrowers. Borrowers are well served when there are multiple sources of capital in the market. Some of the benefits of a CMBS loan include:

| Minimum Loan Amount |

Max LTV |

Term |

Amortization |

| $1,000,000 |

Tiered pricing from 55% – 75% |

5, 7, and 10 Year Fixed Rates |

Up to 30 years |

Apartment Bridge Loan

Very often, a property does not qualify for traditional lender programs for various reasons including: vacant properties, properties with un-stabilized occupancy, properties in need of major repair or remodeling, properties that do not cash flow or are underperforming, or loans that must close with a very quick timeline. These loans are very often best served by a bridge loan. Bridge loans are short-term loans, usually at higher rates than traditional financing that allow the borrower the time and money to reposition a property in order to qualify for traditional bank loans in the future.

| Minimum Loan Amount |

Max LTV |

Term |

Amortization |

| $1,000,000 |

75% |

Typically Up to 3 Years Only |

Interest Only or Amortized |