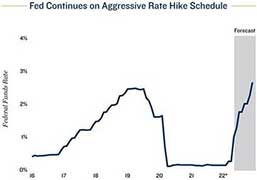

Federal Reserve Increases Fed Funds Rate by 50 Basis Points as Expected

The Fed follows its usual path to combat rising inflation. On May 4, the Federal Reserve increased its Federal Funds rate by 50 basis points. This is the second of approximately seven rate hikes expected this year. Currently, the target range is between 0.75% and 1.00%. The Fed Funds rate is the effective overnight lending rate that the Federal Reserve charges its member banks for short term loans. This rate is expected to climb to the 2% to 3% range by the beginning of 2023 if the Fed continues with its current plan. Many factors continue to drive inflation rates higher. Global supply chains have been disrupted since the beginning of the Covid pandemic, with significant production shutdowns in China. Shortages in labor continue, with twice as many open positions as people looking for jobs. This is creating pressure on wages and driving employee costs higher. The Federal Reserve’s interest rate hikes are intended to relieve these pressures by raising borrowing costs.

Real Estate Cap Rates are facing pressure. Investment returns on commercial real estate dropped significantly over the past 10 years following an increase in demand from investors. Continuing drops in cap rates is not likely, as the Fed moves to tighten monetary policy; however, real estate returns are unlikely to move right along with market interest rates. Strong commercial real estate fundamentals and the projections for above average rental increases are expected keep investors active, softening a potential increase in cap rates for now. A nationwide apartment and housing shortage demonstrates the need for housing of all types, while the dial back in health restrictions have increased traffic for retailers and hotels. Workers are starting to return to in-office jobs, boosting the office market from its pandemic lows. Supply chain problems continue to demonstrate the need for new industrial facilities.

Investors change strategies as margins narrow. The narrowing between real estate investment returns and commercial mortgage rates will cause commercial real estate investors to adjust their investment tactics. Investors are starting to consider smaller, tertiary markets, where competition for properties is less intense. Many apartment investors are considering value-add properties which will require renovation and an increase in rents in order to generate higher investment returns. Rates on Apartment Loans are increasing steadily as they are usually priced over the 10-year treasury rate which has been climbing steadily in 2022. The 10-year treasury is now at its highest level since late 2018. It remains to be seen whether continued rate increases will have a negative effect on investment activity.