Georgia Apartment Loan Rates

| GA Apartment Loan Rates Less Than $6 Million | Free Loan Quote | ||

|---|---|---|---|

| Loan Type | Rate* | LTV | |

| Apartment Loan 5 Yr Fixed | 5.39% | Up to 80% | |

| Apartment Loan 7 Yr Fixed | 5.43% | Up to 80% | |

| Apartment Loan 10 Yr Fixed | 5.52% | Up to 80% | |

*Rates start as low as the rates stated here. Your rate, LTV, and amortization will be determined by underwriting.

Want a personalized quote? Click here to request a customized loan quote for your Georgia apartment property.

Need a multifamily loan over $6 million? Visit our Georgia multifamily loan page. For other commercial property types, explore our Georgia commercial mortgage options. To compare all rates nationwide, see commercial mortgage rates.

Georgia Apartment Market Snapshot (2025)

Average Rent by Metro Area:

- Atlanta-Sandy Springs-Roswell: $1,665

- Augusta-Richmond County: $1,245

- Columbus: $1,135

- Savannah: $1,420

- Statewide Average: $1,480

Vacancy Rates (2025):

- Atlanta Metro: 8.5%

- Augusta: 7.8%

- Savannah: 7.1%

- Statewide Average: ~8.0%

Key 2025 Trends:

- Rent growth has slowed, with annual increases below 1% in most metro areas.

- Significant new apartment supply in Atlanta, leading to elevated vacancy rates.

- Steady apartment building loan activity, especially in secondary cities like Augusta and Savannah.

- Apartment financing remains active, with average cap rates near 5.8% statewide.

Apartment Loans Outlook for 2026 in Georgia

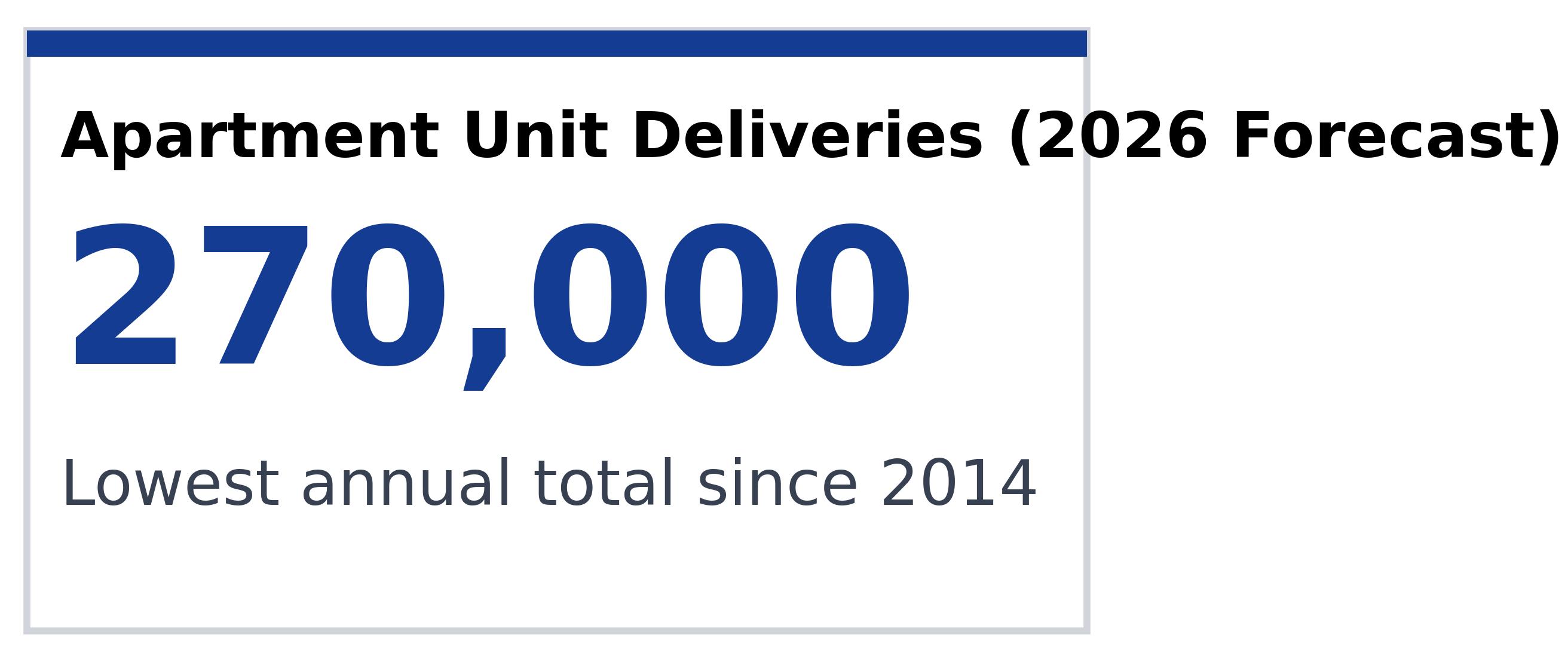

2026 Unit Deliveries Forecast

Going into 2026, rental demand is expected to remain fairly steady across property classes, even with potential headwinds. In Georgia, vacancy is not expected to shift in a meaningful way near term, and overall conditions still point to broad, stable demand for rentals across major metros and quality levels.

For borrowers reviewing apartment loans in Georgia, this is a more practical environment than a speculative one. Instead of relying on rapid rent growth, many apartment lenders are focused on stable occupancy, realistic expenses, and conservative assumptions that hold up if the market stays choppy.

That said, performance may not be uniform across every property. Softer labor conditions and a higher underemployment rate can create pressure on demand, with Class B and Class C apartments facing the greatest exposure if household formation slows among middle- and lower-income renters. Class A properties tend to hold up better when barriers to homeownership keep higher-earning households renting.

New supply is easing at the same time. Approximately 270,000 units are projected for delivery in 2026, the lowest annual total since 2014. With fewer new units coming online, the supply side should create less friction for leasing and support more balanced conditions in Georgia, even if the broader economy remains uneven.

Apartment Building Financing and Apartment Building Loan Trends

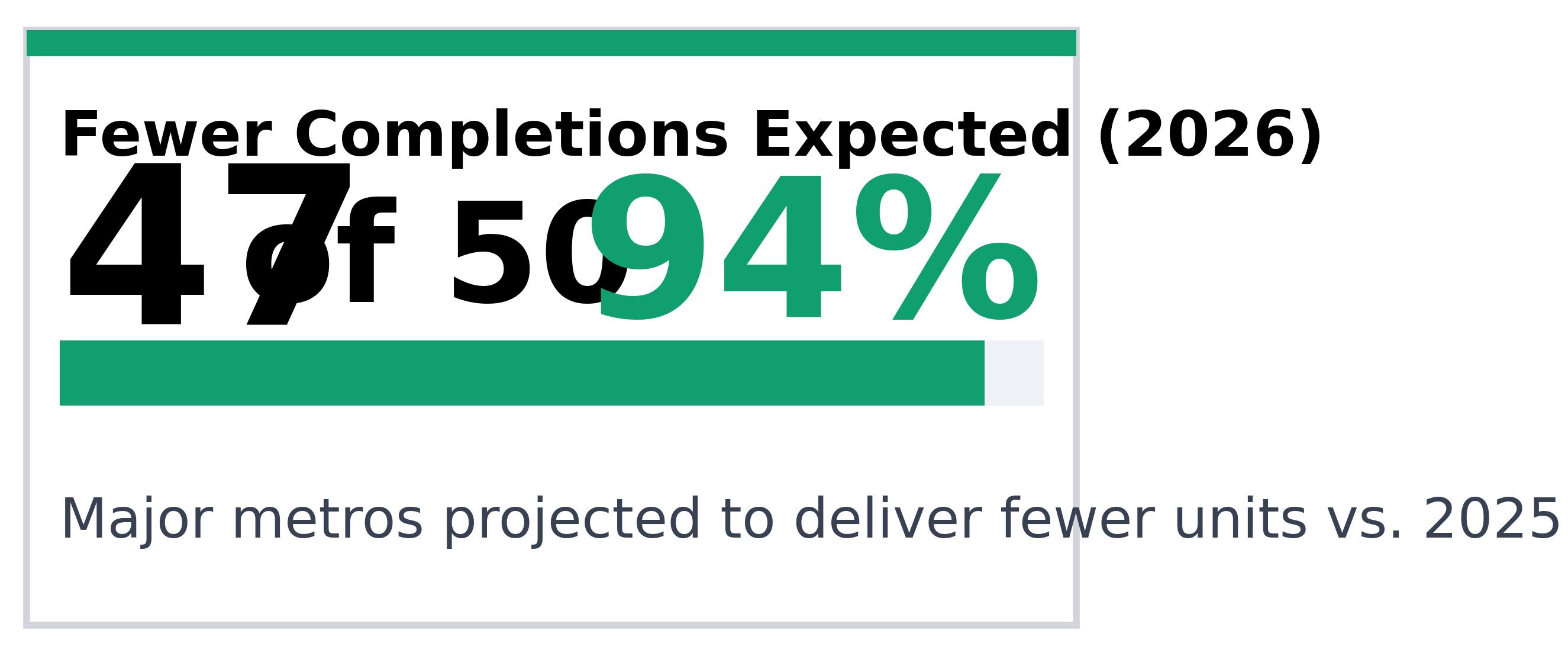

Fewer Completions Expected

The shift in construction activity is one of the clearest dynamics lenders and investors are watching. Most major metros are expected to record fewer completions in 2026, reducing the risk of supply pressure in many markets. For borrowers, that can translate into less competitive pressure from brand-new deliveries, which helps operations remain more dependent on fundamentals like occupancy, renewal rates, and expense control instead of heavy concession strategies.

When you evaluate an apartment building loan in Georgia, lenders still want to see stable cash flow and a realistic plan for maintaining occupancy. In an environment where supply pressure is easing, apartment building financing can place more emphasis on day-to-day performance rather than assuming aggressive rent growth will be needed to make the numbers work.

Even when two quotes look similar, loan terms can vary based on how income is sized, how expenses are treated, reserve expectations, and how much weight is placed on current performance versus a future business plan. This is also why Select Commercial focuses on finding the best rate and terms for your specific loan scenario.

What Apartment Lenders Are Watching Going Into 2026

Renter turnover is a key variable for 2026. In uncertain periods, households tend to postpone major changes, which can translate into fewer moves and stronger renewals. Renewal activity climbed to a more than three-year high late last year, and renewal levels were strongest in Class C properties. For many owners, renewals were a primary driver of rent growth, so retention strategies are expected to remain a major focus in 2026.

Concessions are another factor that can influence occupancy and effective rents. In some markets last year, more than half of units offered discounts, and certain leases at newer properties included multiple months of free rent. As those discounted terms roll off, some renters may shop the market again, which can shift demand between properties and increase competition in areas where concessions were most widespread.

How This Impacts Apartment Loans in Georgia

For apartment loans in Georgia, this is where realistic underwriting matters. Properties that can keep residents in place, maintain occupancy, and manage expenses tend to perform better when the market is not being lifted by rapid rent growth. If you are applying for apartment building financing in Georgia, it helps to work with a team that understands what lenders prioritize and how to position your request for approval.

Key 2026 Themes for Apartment Building Financing

- Apartment loans are becoming more operations-driven: Underwriting is leaning more on current cash flow and sustainable expense control.

- Apartment building loan decisions may be steadier with less new supply: Fewer deliveries can reduce new-lease competition in many markets.

- Apartment lenders are watching renewals closely: Retention and lease rollovers can have a bigger impact when rent growth is moderate.

- Apartment building financing is sensitive to effective rent: Concessions and renewal terms can influence how stable income really is.

If you're looking at a purchase or refinance, Select Commercial can help you structure apartment loans and apartment building financing with the best rate and terms for your specific loan scenario in Georgia.

Why Choose Select Commercial for Apartment Loans

What sets Select Commercial apart from traditional lenders and large banks? In this short video, we highlight the key reasons apartment building investors choose to work with us for Georgia apartment loans between $1.5 million and $6 million. We also actively finance multifamily loans exceeding $6 million.

Here’s what the video touches on:

- No upfront application or processing fees

- Fast written pre-approvals often within 24 hours

- Access to a wide range of apartment lenders, not just one bank

- Loan structures tailored to your property and investment goals

What Lenders Look for in a Georgia Apartment Loan

Before you apply for a Georgia apartment loan, it helps to understand what lenders are actually evaluating. In this short video, Select Commercial President Stephen Sobin outlines the key borrower and property qualifications that influence approval.

Watch to learn:

- What makes a loan request stand out or get rejected

- The importance of cash flow, occupancy, and borrower experience

- Which documents lenders require to issue a pre-approval

Understanding Your Apartment Loan Options

Not all apartment loans are created equal. In this short video, Stephen Sobin explains the most common types of apartment loan programs and when each one makes the most sense for Georgia borrowers.

- Bank vs. agency vs. private apartment lenders

- Short-term vs. long-term fixed-rate options

- How to structure your loan based on your property and investment goals

Our Apartment Loan Application Process

We make applying for a Georgia apartment loan fast, clear, and cost-effective. Below is a step-by-step overview of what to expect when working with Select Commercial:

Step 1: Initial Screening

During an introductory call or email, we gather the basics of your transaction. If the request doesn’t meet loan guidelines, we’ll let you know right away.

Step 2: Document Request

If eligible, we’ll send a short checklist to review your financials, credit, and property cash flow. This includes tax returns, rent rolls, and operating statements.

Step 3: Underwriter Review

Once documents are received, underwriting begins. If your deal qualifies, we issue a written pre-approval. If not, we’ll explain why.

Step 4: Pre-Approval Letter

If approved, we send you a detailed pre-approval letter outlining preliminary terms and any additional requirements.

Step 5: Third-Party Reports

Once pre-approved, the underwriter orders the appraisal and any necessary third-party reports. A good faith deposit is required to cover these costs.

Step 6: Final Submission

When all documentation and reports are in, we finalize underwriting and issue a formal loan commitment.

Step 7: Legal & Closing

Our legal team prepares closing checklists and final conditions. Once satisfied, we schedule the closing.

Step 8: Timeline

Most loans close within 30 to 60 days, depending on the complexity of the deal and speed of document delivery.

Apartment Property Types We Finance in Georgia

At Select Commercial, we arrange financing for a wide range of Georgia apartment buildings, from smaller 5+ unit walkups to large portfolios of rental properties. Whether your property is urban, suburban, or mixed-use, we can help you secure the right loan structure based on your investment goals.

- Urban mid-rise and high-rise apartment buildings

- Suburban garden-style apartment complexes

- Small apartment buildings with 5+ units

- Mixed-use properties with residential and limited commercial space

- Underlying co-op apartment building loans

- Portfolios of small apartment or single-family rental properties

- Stabilized buildings with strong cash flow and rent history

If you're not sure whether your property qualifies, contact us for a free quote and we'll review your deal and let you know within 24 hours.

Recent Apartment Loan Closings

Why Georgia Borrowers Choose Select Commercial

Thousands of apartment building investors trust Select Commercial for our direct, transparent approach and proven expertise in the Georgia apartment loan market. We're not just brokers, we provide personalized service, fast answers, and access to top institutional lenders without the bureaucracy of traditional banks.

- Over 30 years of apartment loan experience with a national platform

- No upfront fees and fast pre-approvals, often within 24 hours

- Direct access to top lenders offering aggressive terms

- Dedicated support from quote to closing

Want to see why so many clients return to us for their next deal? Start with a free quote – we'll review your scenario and respond quickly.

Our Reviews

Latest Expert Insights from Stephen A. Sobin

Stephen A. Sobin, the president of Select Commercial Funding LLC, is a renowned expert in the field of multifamily financing. His insights and perspectives are regularly sought by leading industry publications. Here are his latest contributions that highlight his deep understanding of the multifamily financing landscape and his commitment to providing clear, insightful analysis on key industry issues.

Navigating Opportunity, Risk as 2025 Winds Down

In an article for Commercial Property Executive titled "Navigating Opportunity, Risk as 2025 Winds Down", Sobin explains as we head into the final stretch of 2025, the commercial real estate industry stands at a pivotal moment. After several years of upheaval—from pandemic disruptions to aggressive Federal Reserve rate hikes and lasting shifts in how people live and work—the sector is entering a new phase.

Why Lower Rates Haven't Fixed Commercial Real Estate

In an article for Wealth Management titled "Why Lower Rates Haven't Fixed Commercial Real Estate", Sobin explains that even as the Federal Reserve has begun cutting rates and borrowing costs should be falling, the commercial real estate sector remains locked in a frustrating stalemate. For high-net-worth investors trying to time the market, he emphasizes that understanding this disconnect requires looking beyond the headlines.

Why the Fed Rate Cut’s a Game Changer for CRE

In an article featured in Multi-Housing News, Stephen Sobin highlighted that after months of speculation and market anticipation, the Federal Reserve finally pulled the trigger last week, cutting the federal funds rate by 25 basis points to 4.00 to 4.25 percent. read the full article.

Inflation's Current Impact on Apartment

In an article featured in Multi-Housing News, Sobin explains how commercial mortgage rates continue to challenge investors, with elevated inflation depressing real estate market activity. Read the full article.

Will the July Jobs Report Pressure the Fed to Act?

Sobin noted in Multi-Housing News that unemployment hit a three-year high and job creation slowed significantly, factors that could push the Fed to reconsider future rate hikes. Read the full article.

Persistent Inflation and Its Effects on CRE

In an article featured in Multi-Housing News, Stephen Sobin highlighted that while inflation is still a challenge for the Federal Reserve, there are many positive signs for the commercial real estate industry. The headline Consumer Price Index rose 3.2 percent for the year ended Feb. 29, a figure 20 basis points lower than the Dec. 31, 2023, rate. read the full article.

Commercial Spotlight: Mid-Atlantic Region In this four-state powerhouse, smaller metros are thriving.

In a feature in Scotsman Guide, the Mid-Atlantic Region's real estate dynamics are explored, highlighting its resilience and growth amidst the pandemic.

Stephen Sobin of Select Commercial Funding LLC shared insights on the New York market's allure and the challenges buyers face. He noted the shift from primary urban areas to tertiary markets due to evolving preferences and financial conditions. For a deeper dive into Sobin's analysis, read the full article.

What the New Jobs Report Means for CRE

In an article titled "What the New Jobs Report Means for CRE" in Commercial Property Executive, Stephen Sobin shared his perspective on the latest jobs report and its implications for the Commercial Real Estate (CRE) sector. He highlighted the challenges posed by high interest rates and the prevailing uncertainty in the market. Sobin remarked, "Sellers aren’t selling, buyers aren’t buying... Everyone is waiting because no one knows what to expect." For a detailed analysis and more of Sobin's insights, read the full article.

Decoding "Junk Fees" in Rental Housing

In another latest contribution to Multi-Housing News, Sobin provided expert commentary in an article titled "What's Next for Junk Fees? The Industry Weighs In". He clarified the difference between legitimate fees collected for various third-party services and so-called "junk fees". Sobin emphasized the importance of borrowers understanding their rights in negotiating all loan terms and the obligation of lenders to disclose all fees.

Understanding the Impact of Federal Reserve's Decisions

In a recent article titled "How the Fed's Pause on Interest Rates Impacts Multifamily" published by Multi-Housing News, Sobin shared his expert insights on the Federal Reserve's decision to pause interest rate hikes. He accurately predicted that the Fed would not raise rates in June, citing recent bank failures and lingering concerns about a potential recession.

Stay tuned for more expert insights from Stephen A. Sobin on the evolving multifamily financing landscape.

Frequently Asked Questions About Georgia Apartment Loans

Georgia apartment loan rates vary depending on several factors such as loan-to-value ratio (LTV), property type, borrower experience, and market conditions. As of 2025, rates remain elevated due to ongoing inflation concerns, but borrowers with strong credit and high-quality assets can still find competitive pricing. Check our latest apartment loan rates for current updates.

Most lenders require a DSCR of at least 1.25, good borrower credit, net worth, liquidity, and experience. Loan-to-value ratios in 2025 typically range from 65% to 80%, due to elevated interest rates. Properties with strong occupancy and clean financials stand a better chance of qualifying.

Most lenders require 20% to 25% down for apartment loans in Georgia. Your loan-to-value ratio will be subject to the property's debt service coverage ratio.

A qualified broker like Select Commercial can present your loan to many different capital sources, including banks, credit unions, CMBS, agency lenders, and private funds. This increases the odds of approval and helps you secure the most favorable terms available.

The process starts with gathering financials like a rent roll, trailing 12-month income and expense statement, borrower resume, and net worth statement. A mortgage broker will analyze your documents and match you with the best lending program. Start with a Free Quote today.

Absolutely. While this page focuses on apartment loans under $6 million, Select Commercial also arranges smaller balance loans for qualified borrowers. Visit our multifamily loan page for options over $6 million.

Agency Small Balance Apartment Loan Programs

Select Commercial connects borrowers with top-tier agency small balance loan programs in addition to bank and private capital options. Featured programs include:

- Fannie Mae® Small Loan Program – For apartment properties with 5+ units and loan sizes from $1 million to $6 million

- Freddie Mac® Small Balance Loan (SBL) Program – Streamlined financing solutions up to $6 million

- Loans Over $6 Million – Explore large-balance apartment loan programs in Georgia

These agency-backed options offer competitive fixed rates, non-recourse terms, and simplified underwriting for qualified apartment investors.

Georgia Apartment Building Financing

Select Commercial provides apartment building financing and Georgia commercial mortgages throughout the state of Georgia including but not limited to the areas below.