Baltimore Apartment Loans in 2026

At Select Commercial, we specialize in Baltimore apartment loan solutions for local investors, as well as apartment building financing for larger properties and portfolio needs. Our team of experienced apartment lenders is dedicated to offering competitive rates and tailored programs for apartment investments in the area.

If you are looking for apartment loans outside Baltimore but within Maryland, please visit our Maryland Apartment Loan page. For larger properties, we also offer Maryland Multifamily Loans over $6,000,000.

For comprehensive rates on all loan products available across the 48 states, visit our commercial mortgage rates page, where we offer competitive rates for loans starting at $1,500,000. Explore our insights below on the 2025 Baltimore apartment loan market.

| Baltimore Apartment Loan Rates Under $6 Million | Free Loan Quote | ||

|---|---|---|---|

| Loan Type | Rate* | Max LTV | |

| Apartment 5 Yr Fixed | 5.35% | Up to 80% | |

| Apartment 7 Yr Fixed | 5.39% | Up to 80% | |

| Apartment 10 Yr Fixed | 5.48% | Up to 80% | |

Rates shown apply to typical apartment loan requests under $6 million. Investors seeking apartment building financing or an apartment building loan for a purchase or refinance can speak with our apartment lenders for current program details.

Looking for a larger loan? We also offer Maryland multifamily loan programs for properties over $6 million

.Baltimore Apartment Loan Benefits

Baltimore Apartment Loan rates start as low as 4.95% (as of March 5th, 2026)

• A commercial mortgage broker with over 30 years of lending experience

• No upfront application or processing fees

• Simplified application process

• Up to 80% LTV on apartment financing

• Terms and amortizations up to 30 years

• Apartment loans for purchase and refinance, including cash-out

• 24 hour written pre-approvals with no cost and no obligation

Our Reviews

2026 Baltimore Apartment Loan Market: Vacancy Compresses as Supply Pressure Stays Minimal

Baltimore enters 2026 with vacancy tightening and limited supply pressure. In Baltimore, investors looking for apartment building loans often focus on the same drivers that support a Baltimore apartment loan, including employment direction, the delivery pipeline, vacancy movement, and rent performance.

Employment Outlook Stabilizes After 2025 Losses

Baltimore's employment base is expected to expand by about 3,000 positions in 2026, recovering by year-end from losses that began in 2025. This growth rate falls between Philadelphia and Washington, D.C.

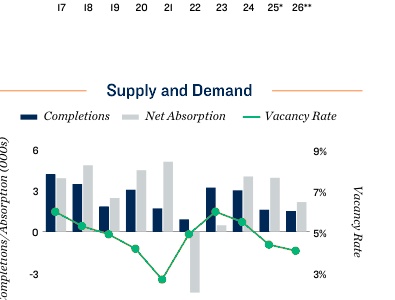

Construction Remains Muted

Contrasting the broader national dynamic, the market's delivery slate adjusts modestly in 2026. Inventory growth is projected at 0.6% for a second straight year, with roughly 1,500 units delivering.

Vacancy Expected to Keep Trending Lower

Metro vacancy is projected to decline for a third straight year, reaching about 4.1% by year-end. That is the lowest level since 2021 and roughly 90 basis points below the trailing decade mean.

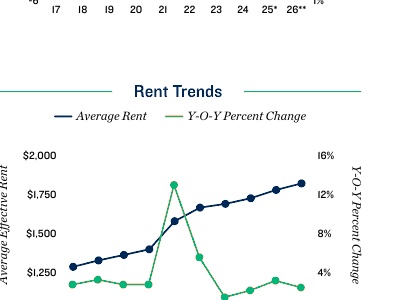

Rent Growth Ranks Near the Top of East Coast Peers

Baltimore's average effective rent is projected to rise to about $1,813 per month in 2026. At roughly +2.4% year-over-year, this ranks Baltimore fourth highest among 13 major East Coast metros.

2026 Baltimore Apartment Loan Market Forecast

- Employment Growth: Baltimore's employment base is projected to expand by about 3,000 positions in 2026.

- Construction Trends: The delivery slate remains modest, with about 1,500 units delivering and inventory growth near 0.6%.

- Vacancy: Metro vacancy is forecast to tighten to about 4.1%, the lowest level since 2021.

- Rent: Average effective rent is projected near $1,813 per month, up about +2.4% year-over-year.

Overall, Baltimore's 2026 setup is defined by compressing vacancy and minimal supply pressure. For Baltimore investors evaluating apartment building loans, these conditions can help support underwriting assumptions and strengthen the case for a Baltimore apartment loan tied to stable occupancy and improving rent performance.

Everything You Need to Know About Baltimore Apartment Loan Rates in 2026

In order to determine apartment loan rates in Baltimore, the first thing an apartment building lender needs to know is the type of property involved. Pricing on apartment loans will usually be lower than pricing for certain other commercial property types, as apartments remain a preferred investment in today's market. After the lender understands the asset class, they will look at the deal metrics, which include Loan to Value ratio (LTV), Debt Service Coverage Ratio (DSCR), and Debt Yield. Loans with a lower LTV and higher DSCR are considered less risky and will have better pricing. Another important deciding factor will be the location of the property. Top quality urban and suburban markets will be preferred over rural locations. One other major deciding factor will be the borrower's experience, credit, net worth, and liquidity. Strong borrowers with experience can expect the best pricing. The bottom line is that apartment lenders need to understand the entire picture before quoting rates. As of March 5, 2026, you can check where apartment loan rates currently start, including options for apartment building financing and refinance.

Baltimore apartment loan rates fluctuate based on current market indices. Most apartment loans and apartment building loan programs are priced over one of the following: the US Treasury rate, the Wall Street Journal Prime Rate, or the Secured Overnight Financing Rate (SOFR). In early 2025, all of these rates are still elevated as a result of the Federal Reserve's actions to curb inflation. As market rates gradually soften, apartment loan rates should trend downward. Many borrowers today are not locking in long term fixed rates, but are opting for shorter term structures and lighter prepayment penalties so that they can refinance when rates are more favorable.

It used to be fairly common to obtain 80% financing when rates were in the 3% and 4% range, as the property's cash flow could support higher levels of debt. In early 2025, with many rates in the 6% and 7% range, cash flow is more restricted due to higher debt service costs. We often see maximum loan to value ratios in the 65% to 70% range today as a result of these higher rates. As market rates ease, we would expect to see higher loan to value ratios and lower down payment requirements for apartment building financing.

Lenders look at many items when deciding whether to approve an apartment loan or an apartment building loan. Some of the most important factors include LTV ratio, DSCR ratio, location of the property, property condition, occupancy, and borrower qualifications (experience, credit, net worth, and cash liquidity). While most of these factors are common sense and assumed by borrowers, the DSCR ratio might need some explanation. DSCR stands for Debt Service Coverage Ratio and is a ratio of the total net operating income divided by the annual debt service. Most lenders will require a DSCR of at least 1.25. This means that for every dollar of mortgage payment, the property must net $1.25 in NOI. While the maximum LTV might be 80%, the property still needs to meet the debt service requirements. Due to higher market rates in 2025, many properties will only cash flow at 65% or 70%. It is important to calculate both LTV and DSCR when looking for a new apartment loan.

Latest Expert Insights from Stephen A. Sobin

Stephen A. Sobin, the president of Select Commercial Funding LLC, is a renowned expert in the field of multifamily financing. His insights and perspectives are regularly sought by leading industry publications. Here are his latest contributions that highlight his deep understanding of the multifamily financing landscape and his commitment to providing clear, insightful analysis on key industry issues.

Navigating Opportunity, Risk as 2025 Winds Down

In an article for Commercial Property Executive titled "Navigating Opportunity, Risk as 2025 Winds Down", Sobin explains as we head into the final stretch of 2025, the commercial real estate industry stands at a pivotal moment. After several years of upheaval—from pandemic disruptions to aggressive Federal Reserve rate hikes and lasting shifts in how people live and work—the sector is entering a new phase.

Why Lower Rates Haven't Fixed Commercial Real Estate

In an article for Wealth Management titled "Why Lower Rates Haven't Fixed Commercial Real Estate", Sobin explains that even as the Federal Reserve has begun cutting rates and borrowing costs should be falling, the commercial real estate sector remains locked in a frustrating stalemate. For high-net-worth investors trying to time the market, he emphasizes that understanding this disconnect requires looking beyond the headlines.

Why the Fed Rate Cut’s a Game Changer for CRE

In an article featured in Multi-Housing News, Stephen Sobin highlighted that after months of speculation and market anticipation, the Federal Reserve finally pulled the trigger last week, cutting the federal funds rate by 25 basis points to 4.00 to 4.25 percent. read the full article.

Inflation's Current Impact on Apartment

In an article featured in Multi-Housing News, Sobin explains how commercial mortgage rates continue to challenge investors, with elevated inflation depressing real estate market activity. Read the full article.

Will the July Jobs Report Pressure the Fed to Act?

Sobin noted in Multi-Housing News that unemployment hit a three-year high and job creation slowed significantly, factors that could push the Fed to reconsider future rate hikes. Read the full article.

Persistent Inflation and Its Effects on CRE

In an article featured in Multi-Housing News, Stephen Sobin highlighted that while inflation is still a challenge for the Federal Reserve, there are many positive signs for the commercial real estate industry. The headline Consumer Price Index rose 3.2 percent for the year ended Feb. 29, a figure 20 basis points lower than the Dec. 31, 2023, rate. read the full article.

Commercial Spotlight: Mid-Atlantic Region In this four-state powerhouse, smaller metros are thriving.

In a feature in Scotsman Guide, the Mid-Atlantic Region's real estate dynamics are explored, highlighting its resilience and growth amidst the pandemic.

Stephen Sobin of Select Commercial Funding LLC shared insights on the New York market's allure and the challenges buyers face. He noted the shift from primary urban areas to tertiary markets due to evolving preferences and financial conditions. For a deeper dive into Sobin's analysis, read the full article.

What the New Jobs Report Means for CRE

In an article titled "What the New Jobs Report Means for CRE" in Commercial Property Executive, Stephen Sobin shared his perspective on the latest jobs report and its implications for the Commercial Real Estate (CRE) sector. He highlighted the challenges posed by high interest rates and the prevailing uncertainty in the market. Sobin remarked, "Sellers aren’t selling, buyers aren’t buying... Everyone is waiting because no one knows what to expect." For a detailed analysis and more of Sobin's insights, read the full article.

Decoding "Junk Fees" in Rental Housing

In another latest contribution to Multi-Housing News, Sobin provided expert commentary in an article titled "What's Next for Junk Fees? The Industry Weighs In". He clarified the difference between legitimate fees collected for various third-party services and so-called "junk fees". Sobin emphasized the importance of borrowers understanding their rights in negotiating all loan terms and the obligation of lenders to disclose all fees.

Understanding the Impact of Federal Reserve's Decisions

In a recent article titled "How the Fed's Pause on Interest Rates Impacts Multifamily" published by Multi-Housing News, Sobin shared his expert insights on the Federal Reserve's decision to pause interest rate hikes. He accurately predicted that the Fed would not raise rates in June, citing recent bank failures and lingering concerns about a potential recession.

Stay tuned for more expert insights from Stephen A. Sobin on the evolving multifamily financing landscape.

Apartment Loan Types We Serve

If you are looking to purchase or refinance a Baltimore apartment building, don't hesitate to contact us. We arrange financing in Baltimore for the following:

- Large urban high-rise apartment buildings

- Suburban garden apartmentcomplexes

- Small apartment buildings containing 5+ units

- Underlying cooperative apartment building loans

- Portfolios of small apartment properties and/or single-family rental properties

- Other multi-family and mixed-use properties

Apartment Loan Helpful Articles

How to Buy an Apartment BuildingUncomplicated Underwriting

How to Invest in an Apartment Building

Are You Shopping for an Apartment Building Loan?

How To Get The Best Rates On An Apartment Refinance

Recent Apartment Loan Closings

Whether you are purchasing or refinancing, we have the right solutions available for your apartment mortgage loans. We will entertain apartment loan requests of all sizes, beginning at $1,500,000. Get started with a Free Commercial Mortgage Loan Quote.

Baltimore Apartment Loans

Select Commercial provides apartment loans throughout Baltimore, Maryland including, but not limited to, the areas below. We provide apartment loans in most major cities throughout the United States.